nh food tax rate

A 9 tax is also assessed on motor vehicle rentals. The meals and rentals mr tax was enacted in 1967 at a rate of 5.

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at 603 230-5920 Filing options - Granite Tax Connect Frequently Asked Questions.

. Chapter 144 Laws of 2009 increased the rate from 8 to the current rate of 9 and added campsites to the definition of hotel. The state meals and rooms tax is dropping from 9 to. Capital and debt service are not current.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. On average homeowners in New. New Hampshire sales tax details New Hampshire NH sales tax is currently 0.

New Hampshire sales tax resources Blog Post Sep 22 2021 New Hampshire firm in its opposition to interstate internet sales tax. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Cost Per Pupil By District Cost per Pupil is based on current expenditures as reported on each school districts Annual Financial Report DOE-25.

Getty Images New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Granite Staters grabbing a bite to eat or staying in a hotel beginning Friday will see a little bit of relief moving forward. How 2021 sales taxes are calculated in new hampshire.

It is one of only 5 states without a sales tax. 43 rows Annual Tax Rate Determination Letters mailed August 26 2021 for the period 712021 Q32021 through 6302022 Q22022. Official NH DHHS COVID-19 Update 34b.

A net rate of 17 is now allocated as 04 AC and 13 UI. New Hampshire Property Tax. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more. State of New Hampshire and the Towns of Hampton North Hampton Rye Seabrook and New Castle to operate seacoast beaches during the COVID-19 pandemic. What is Londonderrys tax rate.

The meals and rooms tax reduction was set in motion by a two-year budget signed by Gov. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. For additional assistance please call the Department of Revenue Administration at 603 230-5920.

This raises obvious questions about a host of other food items like chips. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. For additional assistance please call the Department of Revenue Administration at 603 230-5920.

LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax. Chris Sununu in June. Tax Rate Starting Price Price Increment New Hampshire Sales Tax Table at 0 - Prices from 100 to 4780 Print This Table Next Table starting at 4780 Price Tax 100 000 120 000 140 000 160 000.

Employers can view their current and prior quarter tax rates on our WEBTAX System. Any food service revenue is deducted from current expenditures before dividing by ADM in attendance. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019. Prepared Food is subject to special sales tax rates under New Hampshire law. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown.

Four of those six states include both candy and soda in the rate applied to those lower-taxed groceries. See also the City of Manchester Finance Department for a look at historical property tax rates. Certain purchases including alcohol cigarettes and gasoline may be subject to additional New Hampshire state excise taxes in addition to the sales tax.

Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Food Service guidance issued on May 18 2020.

The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. There are however several specific taxes levied on particular services or products.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7 tax on telecommunications services. While 32 states exempt groceries six additional states Arkansas Illinois Missouri Tennessee Utah and Virginia tax groceries at a lower preferential rate. Prepared Food is subject to special sales tax rates under New Hampshire law.

2012 Tax Rate School 1397 State 109 Town 335 County 236. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Cost per pupil represents current expenditures less tuition and transportation costs.

While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country. A 9 tax is also assessed on motor vehicle rentals. Nh food tax rate.

The state sales tax rate in New Hampshire is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. A net rate of 17 is now allocated as 04 AC and 13 UI. Land Use Department.

The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. Eqkdqb7mjbevtm to ensure a smooth transition to the new tax rate we are. If you need any assistance please contact us at 1-800-870-0285.

States With Highest And Lowest Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

New Hampshire Sales Tax Handbook 2022

How Do State And Local Sales Taxes Work Tax Policy Center

New Hampshire Sales Tax Rate 2022

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

How To Charge Your Customers The Correct Sales Tax Rates

U S States With No Sales Tax Taxjar

New Hampshire Sales Tax Rate 2022

States With The Highest And Lowest Property Taxes Property Tax States Tax

New Hampshire Meals And Rooms Tax Rate Cut Begins

Sales Tax On Grocery Items Taxjar

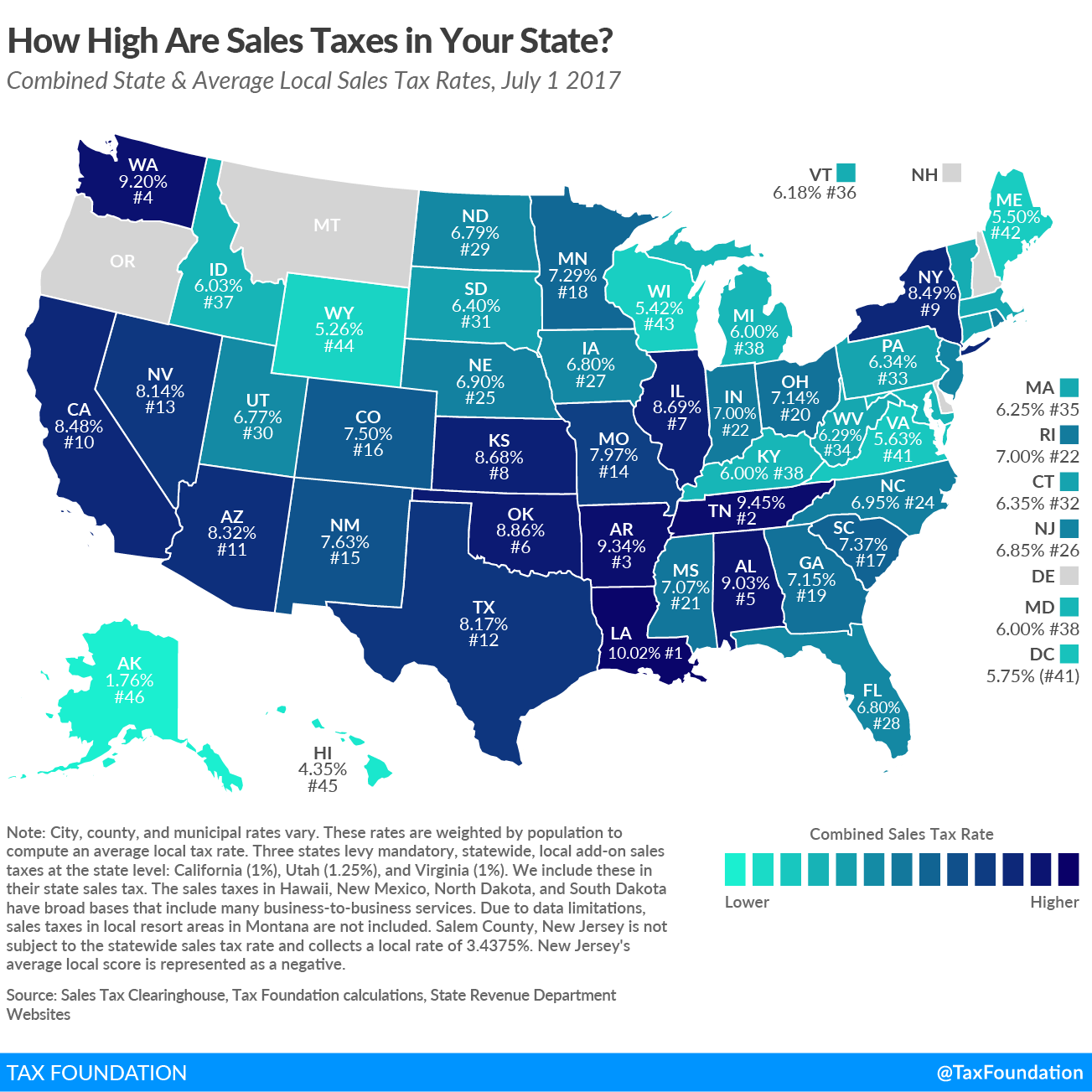

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

Understanding New Hampshire Taxes Free State Project